Life Insurance in and around Trussville

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

Think you are too young for life insurance? Actually, it’s the opposite! You miss out on lots of benefits by waiting. That’s why your Trussville, AL, friends and neighbors both young and old already have State Farm life insurance!

Life goes on. State Farm can help cover it

Life happens. Don't wait.

State Farm Can Help You Rest Easy

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With coverage options from State Farm, you can lock in outstanding costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Nicki Kearley or one of their wise team members. Nicki Kearley can help design a protection plan personalized for coverage you have in mind.

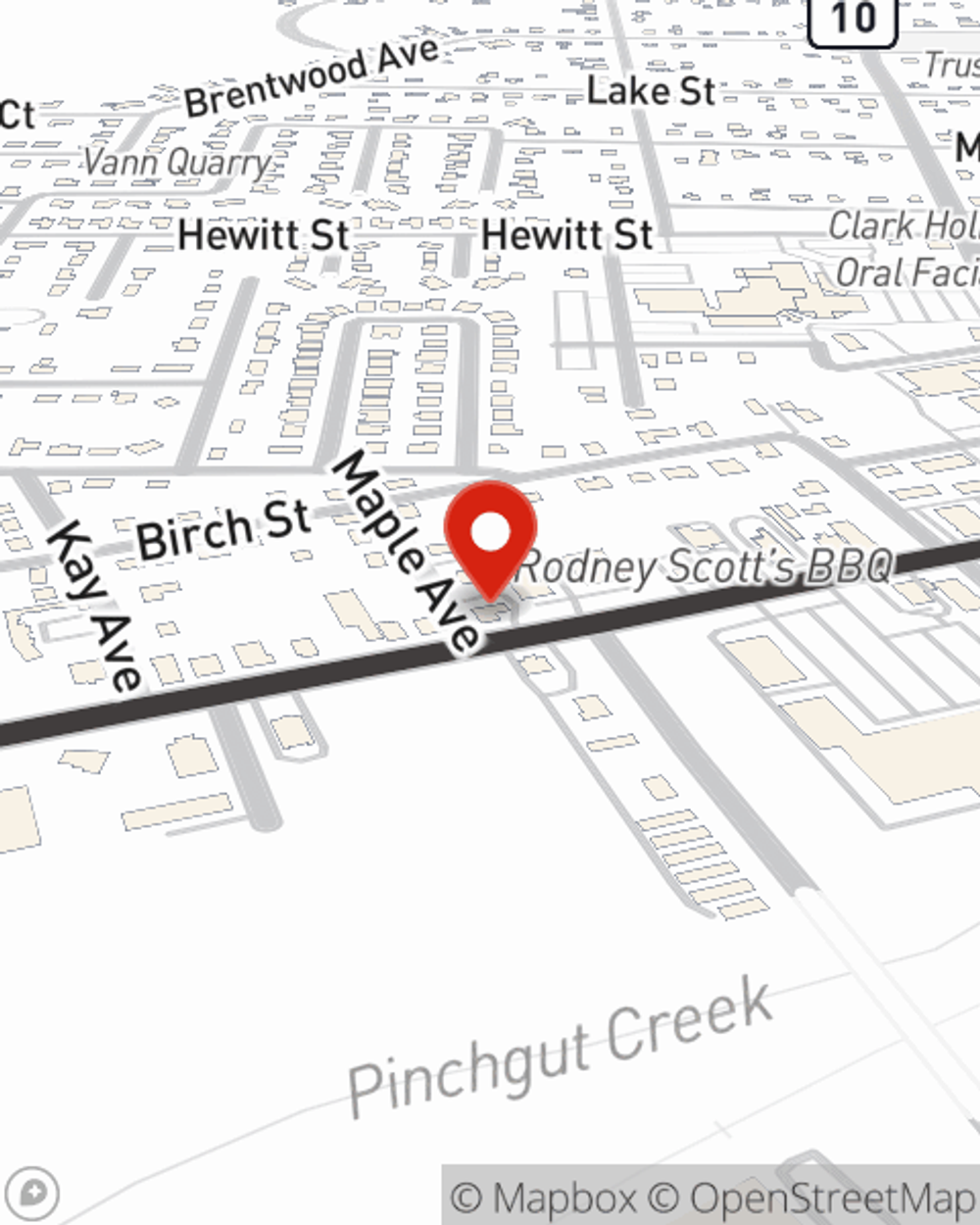

If you're a person, life insurance is for you. Agent Nicki Kearley would love to help you learn more about the variety of coverage options that State Farm offers and help you get a policy that's right for you and your loved ones. Visit Nicki Kearley's office to get started.

Have More Questions About Life Insurance?

Call Nicki at (205) 655-2146 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Nicki Kearley

State Farm® Insurance AgentSimple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.